How I lost $800,000 but created $6 billion in charitable donations

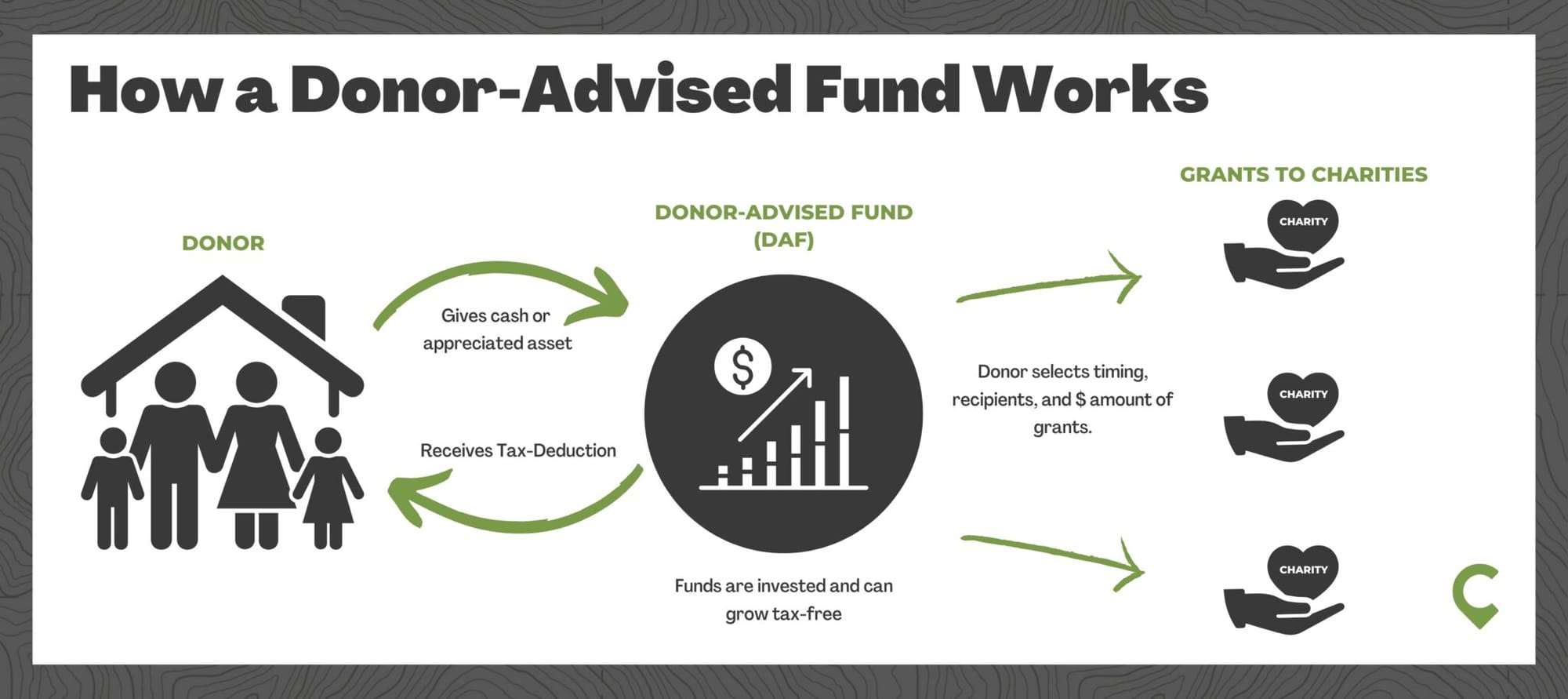

It was 1999 and I was part of the dot com bubble. Following a successful IPO I was looking to give back. I got approached by Eric and David (you've read about Eric here before). The two were excited about their new start up, Wavemaker. Wavemaker was sort of an early version of go funds me, where people could launch campaigns for their favorite charity. The "Wavemaker Platform" was based on something I had not heard of before- a "Donor Advised Fund". I had not heard of Donor Advised Funds but found the idea fascinating. As a door you make a one time or series of donations to a charitable fund, take the tax deduction and then you have a charitable account from which you can direct (advise) to the non profits of your choice. I loved the idea.

Soon Wavemaker was rebranded as "Giving Capital" and our mission switched from crowd sourcing charitable campaigns to providing white label donor advised funds to banks and financial institutions. Our pitch was straight forward to financial adviors- at the end of every year your clients sell stocks, make donations and take a tax deduction. Unfortunately when selling the stock the client pays a capital gains tax and the advisor loses a portion of his or her assets under management. That means the financial advisor gets less compensation and the no profit receives a smaller donation because its AFTER tax. Giving Capital had a better idea. Our financial partners could open an omnibus account with a non profit sponsor. Then, all the donor nee3ded to do was transfer the stock he would have sold to the omnibus account. The result was an increase in the donation (because there was not capital gains tax) and the financial advisor and firm continued to earn fees on the donated stock.

BOOM. In a matter of two years we signed up over a dozen major financial institutions. As predicted, donors began opening donor advised funds in droves and we soon had raised over $600 million for charity. Unfortunately our growth came to a screeching halt when planes flew into the World Trade Center, Pentagon and rural Pennsylvania. We ere venture capital backed and the 9-11 attacks caused every venture firm to close their checkbook. The company that had done so much and was a recognized success as a philanthropic services business was about to declare bankruptcy.

I asked my fellow board members if anyone wanted to buy the company. There were no takers. So, along with the CEO, I bought Giving Capital. In less than 60 days the venture capitalists who had invested alongside me decided they were going to sue me for breach of fiduciary obligation. And so a two plus year of litigation began. I mounted a full defense of my actions and the legal bills mounted. $100,000, then $200,000 etc etc. The legal bills reached $400,000 before the judge threatened my adversary AND their law firm that if they did not stop suing me he was going to cite them with financial penalties. So they gave up.

Unfortunately the US legal system does not have what every other democratic country has- a provision called "loser pays". If you sue someone in England and you lose, you pay the other sides legal fees. Not so here. So I asked the judge to grant me my legal fees and he said no. That would require me to sue the venture capitalists. So I did.

After another year of litigation and $400,000 in additional legal fees, the court found in my favor. I was not allowed to reveal how much I had spent on legal fees (inadmissable) but the jury came back with an award of $800,000. During the litigation the CEO and Im agreed it would be best of we sold Giving Capital. The threat and expense of litigation was killing the company. So we sold it- for nothing. We just wanted it to keep doing good work.

After recovering $800,000 from the venture capital guys I had lost another $800,000 that I invested in Giving Capital. But, as Paul Harvey used to say "here is the rest of the story". The Giving Capital platform continues to exist today under a different name and continues to serve huge financial institutions. The charitable donations now exceed $6 billion.

I like to say my investment in Giving Capital was a financial disaster but a philanthropic success. I made life long friends in the process and now that a few decades have passed the loss I encountered stings a little less. Donor Advised Funds are a good thing and if you are looking for a smart way to be philanthropic, you could do worse than open one yourself.

Vanguard, Fidelity and many other banks and community foundations offer donor advised funds. The offerings are similar but smaller sponsors of donor advised finds may offer more flexibility.

If you liked this article or found it informative, please forward it to a friend.